Old users can buy the application for Rs.

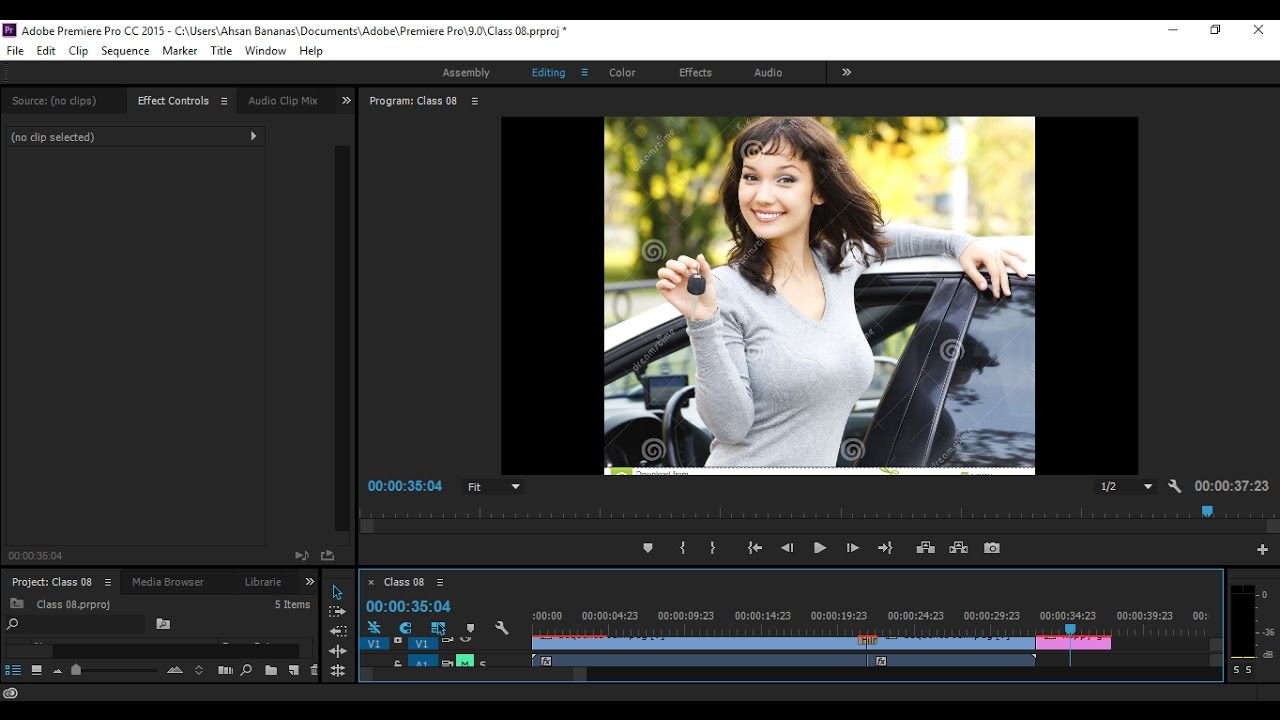

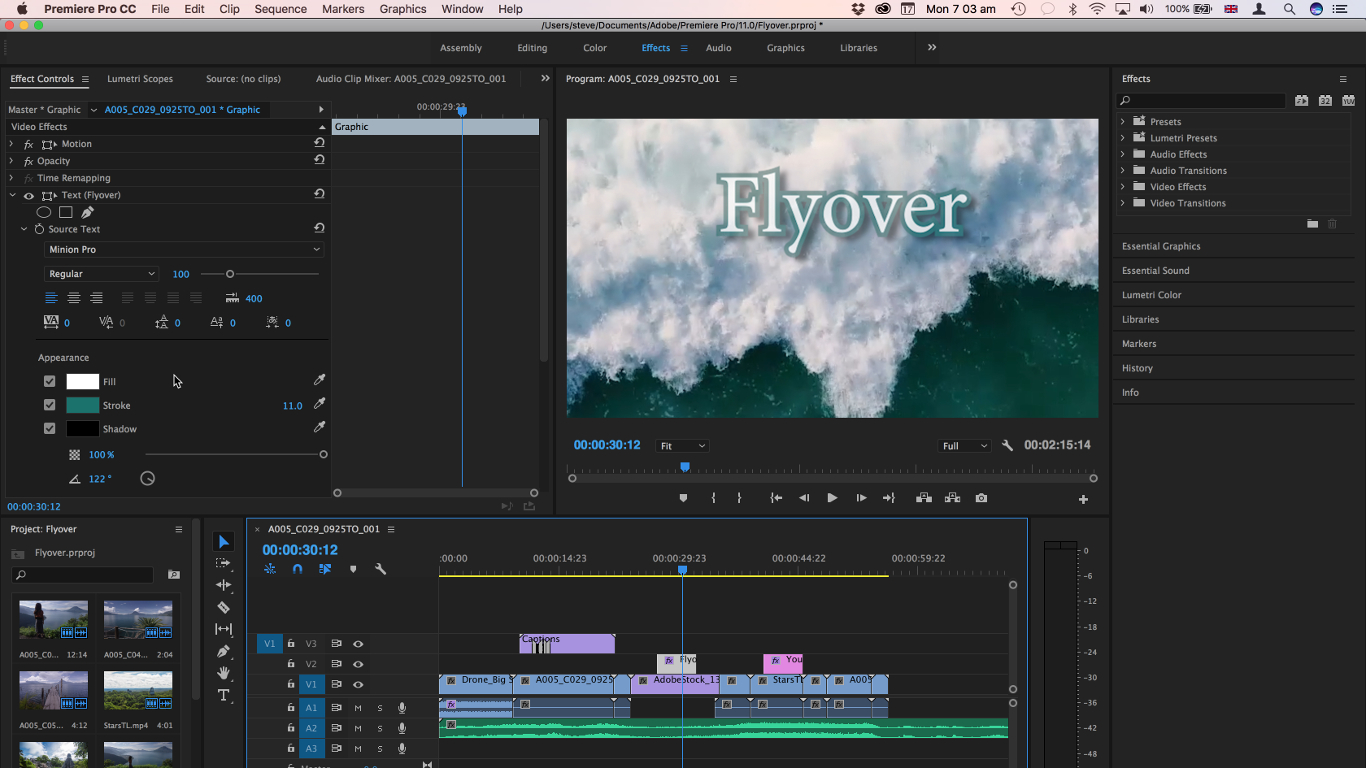

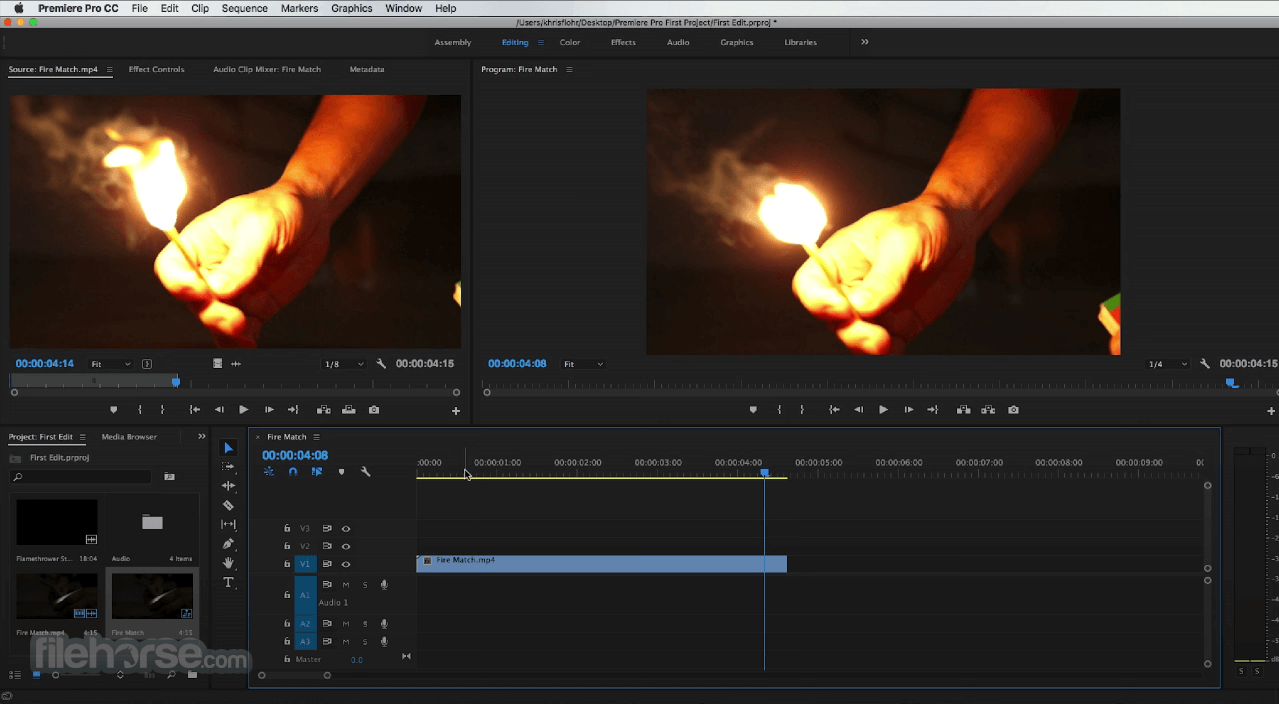

ADOBE CC PREMIERE PRO SOFTWARE

The price of the software also differs for new buyers with that of old users who want to renew their plans. Select the plan you require by calculating the total estimate for each type. For 2 users per year, you need to pay Rs. In the first case, the price you have to pay per user, per year is Rs.

ADOBE CC PREMIERE PRO PRO

The pricing of Adobe Premiere Pro CC for teams will depend upon your requirements.įor instance, if you require the Level-1 option (single user) for a year, the price would be higher than that of the level-2 option for the same.

ADOBE CC PREMIERE PRO PROFESSIONAL

It can be a great option for creative professionals like motion graphics designers, producers and filmmakers who are looking for quality outcomes to take their business on the next level.Īre you a proficient creative professional who switches between various Adobe products for a more efficient editing experience? Adobe Premiere Pro CC for teams allows the user to have access to world-class desktop apps and services, such as Photoshop CC, Illustrator CC, and InDesign CC. The software supports a wide range of formats and is compatible with both Windows and macOS. Adobe Premiere Pro CC for teams offers industry-leading tools to address all your video-editing needs.

It creates a professional editing experience and is ideal for your small-screen to big-screen projects.

Invoice will not be entertained by or the Seller. Include the user's GSTIN and the name of the business entity Please be aware that the GST invoice must if an exchange offer is made concurrently with the if the items come with Value Added Services such asĬomplete Mobile Protection or Assured Buyback. The following goods and services will not be eligible On the Platform's product detail page will be qualified Sellers and bearing the callout "GST Invoice Available" Only specific items sold by participating Please be aware that not every product qualifies for a The User's specified Entity Name for the User's

The GSTIN submitted by the User in connection with the Other things, have the following information printed on The purchase of all such products, which will, among The user will be sent a Tax Invoice ("GST invoice") for Through the Platform for business, advertising, resale, or Users are forbidden from using any of the products they buy However, all purchases made on the Platform must be for personal Products from merchants on the platform that meet their needs. Users who have registered businesses can buy

0 kommentar(er)

0 kommentar(er)